One of Leading ACCA Training In UAE

Get affordable ACCA training in the UAE. Learn about ACCA COURSE Duration, Eligibility, Exam level, Subjects, Charges & Fees and exemptions in UAE, Sharjah, Dubai. Looking to build a global career in finance and accounting? Our ACCA training in Sharjah is designed to equip students with the knowledge, skills, and qualifications needed to succeed in today dynamic financial landscape. At Al Mihad Training Centre, we offer a comprehensive ACCA course in UAE that aligns with the latest global standards and ACCA newly updated qualification structure. Whether you're starting your journey or enhancing your professional credentials, our expert-led programs ensure that you receive high-quality education, flexible learning options, and international recognition. Join our ACCA classes in Sharjah today and take the first step toward becoming a globally certified accounting professional.

-

Learn More

ACCA:- Association of Chartered Certified Accountants

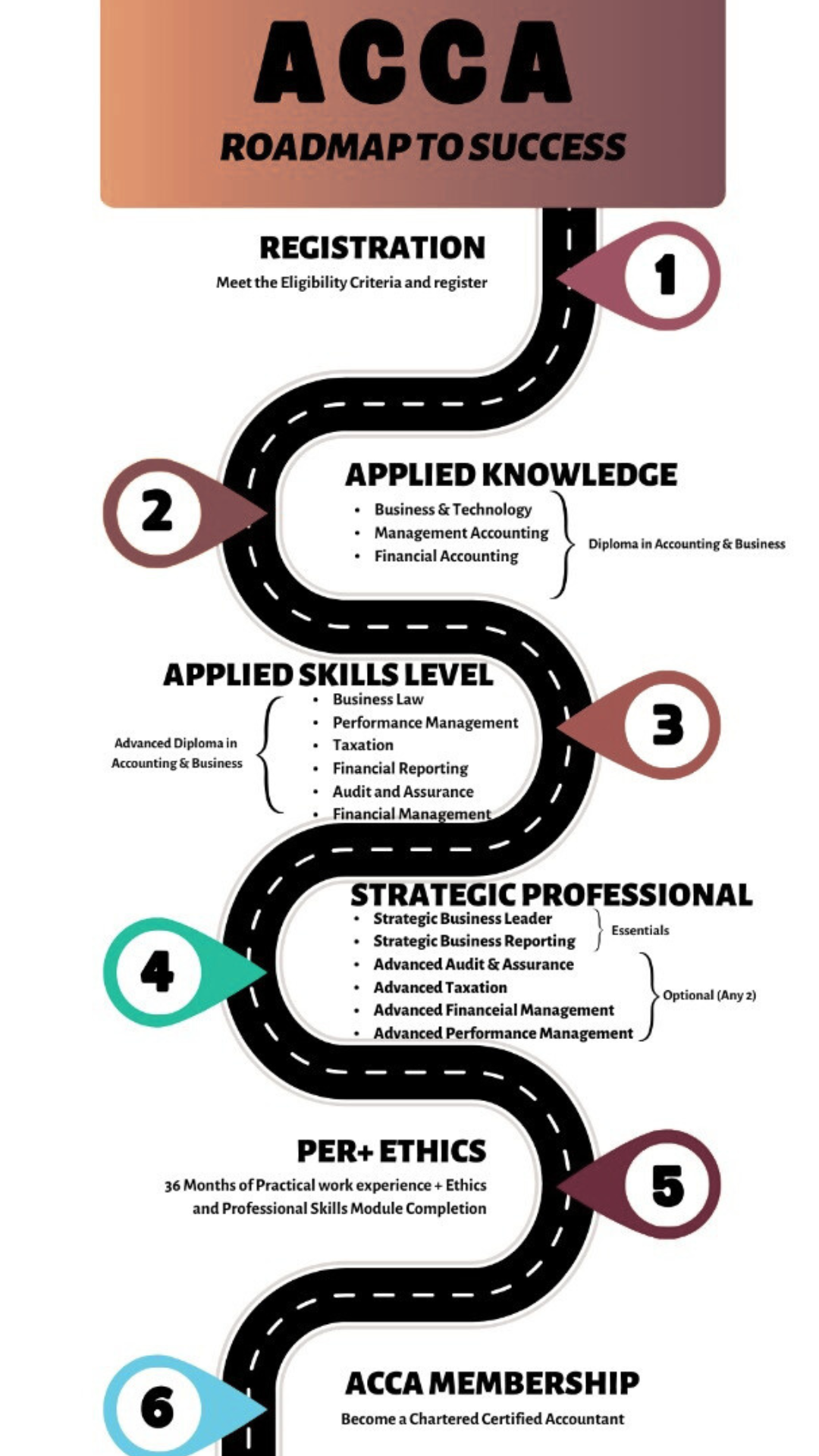

The Association of Chartered Certified Accountants (ACCA) is a leading global professional accounting body founded in 1904 and headquartered in London, United Kingdom. It offers the prestigious Chartered Certified Accountant qualification, which is recognized in over 180 countries worldwide. With more than 240,000 members and 600,000 students globally, ACCA aims to provide accessible, high-quality education and promote excellence, integrity, and innovation within the accounting profession. The ACCA qualification is structured to develop both technical and professional skills through a series of exams, an Ethics and Professional Skills Module, and a Practical Experience Requirement of 36 months. It prepares individuals for diverse careers in auditing, taxation, finance, and management across public practice, industry, and government sectors. ACCA s global recognition makes it a valuable credential for professionals aspiring to build successful international careers in accountancy and finance.

The ACCA qualification is structured to ensure that aspiring accountants develop the necessary knowledge, skills, and values required in today dynamic business environment. It is divided into three key stages Applied Knowledge, Applied Skills, and Strategic Professional each designed to progressively build expertise in areas such as financial reporting, auditing, taxation, management accounting, and business leadership. In addition to passing 13 examinations, candidates must complete the Ethics and Professional Skills Module (EPSM) and gain three years (36 months) of relevant practical experience, known as the Practical Experience Requirement (PER).

Eligibility

Eligibility Criteria Details Minimum Requirement 3 GCSEs and 2 A-Levels (including Math & English) or equivalent

Alternative Entry Non-graduates can start with Foundations in Accountancy (FIA)

Graduate Entry Graduates in accounting/finance may be eligible for exemptions (up to 9 papers)

Exam Structure

13 exams split into 3 levels:

1. Applied Knowledge (3 papers): Business and Technology, Management Accounting, Financial Accounting

2. Applied Skills (6 papers) : including Taxation, Audit & Assurance, Financial Management

3. Strategic Professional (4 papers) : Advanced Financial Management, Strategic Business Leader, etc

Exam Format: Computer-based exams, multiple-choice + written case studies.

Frequency: Exams in March, June, September, December.

After learnig this program you are able to ..

Build a global career in finance and accounting.Eligible roles include:

~> Finance Manager

~>Auditor

~>Tax Consultant

~>Business Analyst

~>Chief Financial Officer (CFO)

ACCA members are highly sought after by:

~> Big 4 firms :1PwC, EY, Deloitte, and KPMG

~> Leading banks

~> Multinational corporations (MNCs)

Why Choose Mihad Training Institute?

At Mihad Training Institute, we dont just prepare you for exams we prepare you for a global career in finance, accounting, and business leadership.

We offer a personalized learning path starting with an aptitude test, guiding you to the right qualification and creating a customized study roadmap. Our expert faculty are industry professionals and certified ACCAs, delivering practical knowledge, case studies, and exam-focused training.

With flexible learning options weekday, weekend, evening, online, and hybrid classes you can study at your pace, supported by one-to-one mentorship, doubt clearing, and performance tracking. Mock exams, real exam simulations, and intensive revision sessions build confidence and improve your chances of passing on the first attempt.

Mihad graduates enjoy global recognition and career support, with placements in top firms, banks, and MNCs. Our proven track record ensures high pass rates and long-term success.

ACCA Traning at Al Mihad covers:

- The ACCA qualification proves to employers that you have ability in all aspects of business and enables you to work in any aspect of finance or management in any business.

- Qualification can be obtained in minimum 2 years time but 3 years practical experience is required to become a member.

- Benefits are better employment, higher status, valuable skills and knowledge.

- Current ACCA Training Program offers Modular Structure

- New Options: Data Science -> Corporate Finance -> Tax Advisory

- Get Recognized Early: Earn Diplomas & Degrees Along the Way

- Built for Today s Finance World ACCA is Future-Ready

Check Out Customer Feedback

Pleasure to share some of our customers feedback.

Dayana

Mihad Training provided me with the best ACCA coaching experience. The instructors were knowledgeable, and their support helped me pass my exams with confidence. Highly recommended!

Alius

he trainers at Mihad Training make complex ACCA topics easy to understand. Their practical approach and real-world examples made a huge difference in my learning. Thank you!

Priya R

Balancing work and studies was tough, but Mihad Training�s flexible schedule and expert guidance made it possible. The study materials were top-notch, and I felt fully prepared for my exams.

James

Enrolling at Mihad Training was the best decision for my ACCA journey. The personalized attention and interactive sessions kept me motivated. I wouldn�t have done it without them!

Questions & Answers

Find answers to all your queries about our service.

-

What is ACCA, and what are its benefits?

ACCA (Association of Chartered Certified Accountants) is a globally recognized accounting qualification. It offers career opportunities in finance, audit, and taxation, with flexibility, high earning potential, and recognition in over 180 countries.

-

How long does it take to complete the ACCA qualification?

ACCA takes around 3 to 4 years to complete, but students with exemptions can finish in 1.5 to 2 years. It includes 13 exams, 36 months of work experience, and an ethics module.

-

What are the eligibility requirements for ACCA?

The minimum requirement is two A-levels and three GCSEs (or equivalent), including English and Mathematics. Degree holders in relevant fields may receive exemptions. Those without qualifications can start with Foundations in Accountancy (FIA).

-

What is the exam structure of ACCA?

ACCA has three levels: Applied Knowledge (3 exams), Applied Skills (6 exams), and Strategic Professional (4 exams, including 2 optional). The exams cover accounting, finance, taxation, and business management.

Did get, Click below button to more anwers or contact us.